Payroll tax calculator 2020

Starting 2020 there are new requirements for the DE 4. 1 online tax filing solution for self-employed.

Excel Formula Income Tax Bracket Calculation Exceljet

1 QuickBooks Payroll is the 1 online payroll service provider for small businesses.

. Americas 1 tax preparation provider. Payroll tax is a state tax assessed on wages paid or payable to employees by an employer whose total Australian taxable wages exceeds the threshold amount. Figure the tentative tax to withhold.

If the return is not complete by 531 a 99 fee. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

DE 4P Withholding Certificate for Pension or Annuity Payments. Tax Calculation for an. Employers and employees split the tax.

202223 Tax Refund Calculator. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. This calculator allows you to calculate your estimated rate of payroll tax.

Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. Based on the overall number of customers for QuickBooks payroll products as of 062020. Total Non-Tax Deductions.

Since early 2020. The rate is based on annualised wages. 2022-23 Trust Land Tax Rate Calculator.

If you employ for only 150 days in the year and the wages paid during that period is 630 000 your annualised wages total would be calculated as follows. Almost all employers automatically withhold taxes from their employees paychecks independent contractors and self-employed. Or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

The final tax result for you will depend to a great extent on the amount of. Based on overall number of customers for QuickBooks Payroll products as of 82021. Use a calculator.

630 000 divided by 150 then multiplied by 365 or 366 days. An updated look at the Philadelphia Phillies 2022 payroll table including base pay bonuses options tax allocations. We can also help you understand some of the key factors that affect your tax return estimate.

1 July 2021 to 30 June 2022. 2022-23 General Land Tax Rates Calculator. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. 1 July 2022 to 30 June 2023. Elective Deferrals401k etc Payroll Taxes Taxes.

Land held on trust Land held on trust Menu. Please use our Income Tax Calculator. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. DE 4S Request for State Income Tax Withholding From Sick Pay. Does my organisation need to register for.

Oregon personal income tax withholding and calculator Currently selected. 2 We help 14 million businesses do payroll and file taxes. State Date.

Offer valid for returns filed 512020 - 5312020. Self-Employed defined as a return with a Schedule CC-EZ tax form. Tax base Income tax Net salary Work insurance contribution Company taxes Total company cost Disclaimer.

Its important to remember people working in these offices do not know the rest of. Payroll offices and human resource departments are responsible only for processing the Form OR-W-4. An updated look at the Colorado Rockies 2022 payroll table including base pay bonuses options tax allocations.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987. If you receive a salary only as an employee on a German payroll you get a more accurate result by using the German Wage Tax Calculator.

Other Oregon deductions and modifications. The payroll tax threshold increased to 12 million from 1 July 2020. Account for dependent tax credits.

Internal Revenue Service Withholding Calculator Identify your tax withholding to make sure you have the right amount of tax withheld. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. No cash value and void if transferred or where prohibited.

Calculate Land Tax Calculate Land Tax Menu. Switch to hourly calculator. Land held on trust up to 2019-20.

APEX Team - Payroll Calculator ver. Use 2020 W4. Your job income salary year.

The Payroll Calculator is intended to be a general information tool on payroll simulations. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Pre-Tax Deductions Pre-tax Deduction Rate Annual Max Prior YTD CP.

For the past couple of decades however FICA tax rates have remained consistent. The income tax calculator for Sweden allows you to select the number of payroll payments you receive in a year this could be 12 1 a month 13 with bonus 14 with additional payments or more you can choose the number of payroll payments in the year to produce an annual income tax calculati. 2020-21 land tax changes.

Medicare tax rates rose from 035 in 1966 when they were first implemented to 135 in 1985. How is land tax assessed. 07102020 2022 Parameters Rate RON EUR USD Input the exchange rate for EUR USD calculation.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

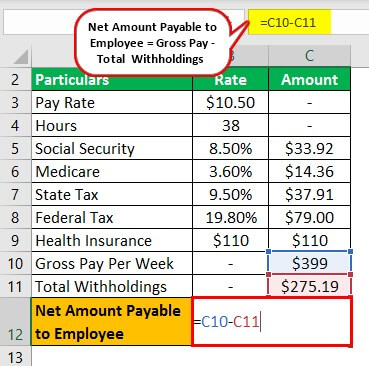

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Sondrassong Org

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Formula Step By Step Calculation With Examples

How Much Does A Small Business Pay In Taxes

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

2022 Income Tax Withholding Tables Changes Examples

How Is Taxable Income Calculated How To Calculate Tax Liability

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator 2020 Online 54 Off Myelectricalceu Com